Page 236 - Annual Report 2020

P. 236

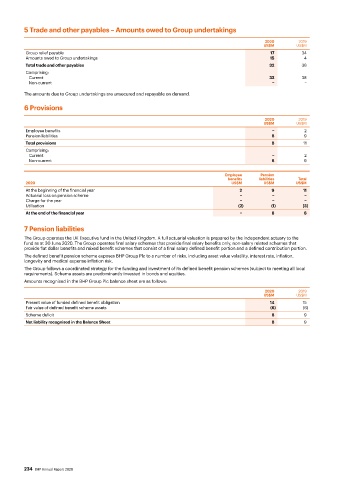

5 Trade and other payables – Amounts owed to Group undertakings

2020 2019

US$M US$M

Group relief payable 17 34

Amounts owed to Group undertakings 15 4

Total trade and other payables 32 38

Comprising:

Current 32 38

Non-current − −

The amounts due to Group undertakings are unsecured and repayable on demand.

6 Provisions

2020 2019

US$M US$M

Employee benefits − 2

Pension liabilities 8 9

Total provisions 8 11

Comprising:

Current − 2

Non-current 8 9

Employee Pension

benefits liabilities Total

2020 US$M US$M US$M

At the beginning of the financial year 2 9 11

Actuarial loss on pension scheme − − −

Charge for the year − − −

Utilisation (2) (1) (3)

At the end of the financial year − 8 8

7 Pension liabilities

The Group operates the UK Executive fund in the United Kingdom. A full actuarial valuation is prepared by the independent actuary to the

fund as at 30 June 2020. The Group operates final salary schemes that provide final salary benefits only, non-salary related schemes that

provide flat dollar benefits and mixed benefit schemes that consist of a final salary defined benefit portion and a defined contribution portion.

The defined benefit pension scheme exposes BHP Group Plc to a number of risks, including asset value volatility, interest rate, inflation,

longevity and medical expense inflation risk.

The Group follows a coordinated strategy for the funding and investment of its defined benefit pension schemes (subject to meeting all local

requirements). Scheme assets are predominantly invested in bonds and equities.

Amounts recognised in the BHP Group Plc balance sheet are as follows:

2020 2019

US$M US$M

Present value of funded defined benefit obligation 14 15

Fair value of defined benefit scheme assets (6) (6)

Scheme deficit 8 9

Net liability recognised in the Balance Sheet 8 9

234 BHP Annual Report 2020