Page 237 - Annual Report 2020

P. 237

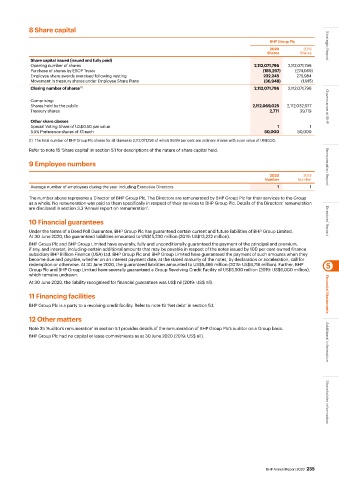

8 Share capital

BHP Group Plc

2020 2019 Strategic Report

Shares Shares

Share capital issued (issued and fully paid)

Opening number of shares 2,112,071,796 2,112,071,796

Purchase of shares by ESOP Trusts (185,297) (274,069)

Employee share awards exercised following vesting 222,245 275,984

Movement in treasury shares under Employee Share Plans (36,948) (1,915)

Closing number of shares (1) 2,112,071,796 2,112,071,796

Comprising:

Shares held by the public 2,112,069,025 2,112,032,077 Governance at BHP

Treasury shares 2,771 39,719

Other share classes

Special Voting Share of US$0.50 par value 1 1

5.5% Preference shares of £1 each 50,000 50,000

(1) The total number of BHP Group Plc shares for all classes is 2,112,071,796 of which 99.99 per cent are ordinary shares with a par value of US$0.50.

Refer to note 15 ‘Share capital’ in section 5.1 for descriptions of the nature of share capital held.

9 Employee numbers Remuneration Report

2020 2019

Number Number

Average number of employees during the year including Executive Directors 1 1

The number above represents a Director of BHP Group Plc. The Directors are remunerated by BHP Group Plc for their services to the Group

as a whole. No remuneration was paid to them specifically in respect of their services to BHP Group Plc. Details of the Directors’ remuneration

are disclosed in section 3.3 ‘Annual report on remuneration’.

10 Financial guarantees Directors’ Report

Under the terms of a Deed Poll Guarantee, BHP Group Plc has guaranteed certain current and future liabilities of BHP Group Limited.

At 30 June 2020, the guaranteed liabilities amounted to US$15,230 million (2019: US$13,222 million).

BHP Group Plc and BHP Group Limited have severally, fully and unconditionally guaranteed the payment of the principal and premium,

if any, and interest, including certain additional amounts that may be payable in respect of the notes issued by 100 per cent owned finance

subsidiary BHP Billiton Finance (USA) Ltd. BHP Group Plc and BHP Group Limited have guaranteed the payment of such amounts when they

become due and payable, whether on an interest payment date, at the stated maturity of the notes, by declaration or acceleration, call for

redemption or otherwise. At 30 June 2020, the guaranteed liabilities amounted to US$5,466 million (2019: US$8,716 million). Further, BHP 5

Group Plc and BHP Group Limited have severally guaranteed a Group Revolving Credit Facility of US$5,500 million (2019: US$6,000 million),

which remains undrawn.

At 30 June 2020, the liability recognised for financial guarantees was US$ nil (2019: US$ nil).

11 Financing facilities Financial Statements

BHP Group Plc is a party to a revolving credit facility. Refer to note 19 ‘Net debt’ in section 5.1.

12 Other matters

Note 35 ‘Auditor’s remuneration’ in section 5.1 provides details of the remuneration of BHP Group Plc’s auditor on a Group basis.

BHP Group Plc had no capital or lease commitments as at 30 June 2020 (2019: US$ nil). Additional information

BHP Annual Report 2020 235 Shareholder information