Page 20 - Annual Report 2020

P. 20

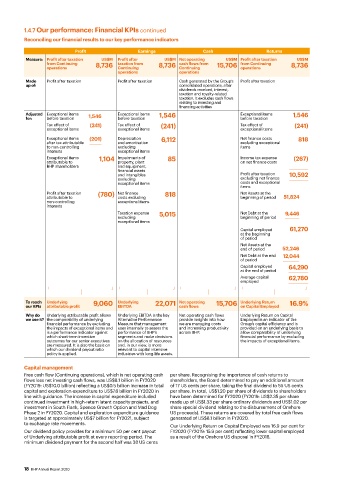

1.4.7 Our performance: Financial KPIs continued

Reconciling our financial results to our key performance indicators

Profit Earnings Cash Returns

Measure: Profit after taxation US$M Profit after US$M Net operating US$M Profit after taxation US$M

from Continuing 8,736 taxation from 8,736 cash flows from 15,706 from Continuing 8,736

operations Continuing Continuing operations

operations operations

Made Profit after taxation Profit after taxation Cash generated by the Group’s Profit after taxation

up of: consolidated operations, after

dividends received, interest,

taxation and royalty-related

taxation. It excludes cash flows

relating to investing and

financing activities

Adjusted Exceptional items 1,546 Exceptional items 1,546 Exceptional items 1,546

for: before taxation before taxation before taxation

Tax effect of (241) Tax effect of (241) Tax effect of (241)

exceptional items exceptional items exceptional items

Exceptional items (201) Depreciation 6,112 Net finance costs 818

after tax attributable and amortisation excluding exceptional

to non-controlling excluding items

interests exceptional items

Exceptional items 1,104 Impairments of 85 Income tax expense (267)

attributable to property, plant on net finance costs

BHP shareholders and equipment,

financial assets

and intangibles Profit after taxation 10,592

excluding excluding net finance

exceptional items costs and exceptional

items

Profit after taxation (780) Net finance 818 Net Assets at the

attributable to costs excluding beginning of period 51,824

non-controlling exceptional items

interests

Taxation expense 5,015 Net Debt at the 9,446

excluding beginning of period

exceptional items

Capital employed 61,270

at the beginning

of period

Net Assets at the

end of period 52,246

Net Debt at the end 12,044

of period

Capital employed 64,290

at the end of period

Average capital 62,780

employed

To reach Underlying 9,060 Underlying 22,071 Net operating 15,706 Underlying Return 16.9%

our KPIs attributable profit EBITDA cash flows on Capital Employed

Why do Underlying attributable profit allows Underlying EBITDA is the key Net operating cash flows Underlying Return on Capital

we use it? the comparability of underlying Alternative Performance provide insights into how Employed is an indicator of the

financial performance by excluding Measure that management we are managing costs Group’s capital efficiency and is

the impacts of exceptional items and uses internally to assess the and increasing productivity provided on an underlying basis to

is a performance indicator against performance of BHP’s across BHP. allow comparability of underlying

which short-term incentive segments and make decisions financial performance by excluding

outcomes for our senior executives on the allocation of resources the impacts of exceptional items.

are measured. It is also the basis on and, in our view, is more

which our dividend payout ratio relevant to capital intensive

policy is applied. industries with long-life assets.

Capital management

Free cash flow (Continuing operations), which is net operating cash per share. Recognising the importance of cash returns to

flows less net investing cash flows, was US$8.1 billion in FY2020 shareholders, the Board determined to pay an additional amount

(FY2019: US$10.0 billion) reflecting a US$0.5 billion increase in total of 17 US cents per share, taking the final dividend to 55 US cents

capital and exploration expenditure to US$7.6 billion in FY2020 in per share. In total, US$1.20 per share of dividends to shareholders

line with guidance. The increase in capital expenditure included have been determined for FY2020 (FY2019: US$2.35 per share

continued investment in high-return latent capacity projects, and made up of US$1.33 per share ordinary dividends and US$1.02 per

investment in South Flank, Spence Growth Option and Mad Dog share special dividend relating to the disbursement of Onshore

Phase 2 in FY2020. Capital and exploration expenditure guidance US proceeds). These returns are covered by total free cash flows

is targeted at approximately US$7 billion for FY2021, subject generated of US$8.1 billion in FY2020.

to exchange rate movements. Our Underlying Return on Capital Employed was 16.9 per cent for

Our dividend policy provides for a minimum 50 per cent payout FY2020 (FY2019: 15.9 per cent) reflecting lower capital employed

of Underlying attributable profit at every reporting period. The as a result of the Onshore US disposal in FY2018.

minimum dividend payment for the second half was 38 US cents

18 BHP Annual Report 2020