Page 166 - Annual Report 2020

P. 166

3.3.22 Prohibition on hedging of BHP Group 3.3.24 Payments to past Directors

shares and equity instruments and for loss of office

The CEO and other Executive KMP may not use unvested BHP UK regulations require the inclusion in the Remuneration Report

equity awards as collateral or protect the value of any unvested of certain payments to past Directors and payments made for

BHP equity awards or the value of shares and securities held loss of office.

as part of meeting the MSR. The following payments were made to Andrew Mackenzie that relate

Any securities that have vested and are no longer subject to the period when he was no longer an Executive Director and CEO

to restrictions may be subject to hedging arrangements and which have not been reported in sections 3.3.1 and 3.3.18:

or used as collateral, provided that prior consent is obtained. • 48 per cent of the 322,765 retained LTIP awards granted in 2015,

reduced from 339,753 awards originally granted and prorated for

3.3.23 Share ownership guidelines time served at the time of departure, vested on 19 August 2020.

The value of these awards for Andrew was US$5.317 million,

and the MSR including a related DEP of US$0.919 million which was paid

in shares.

The share ownership guidelines and the MSR help to ensure the

interests of Directors, executives and shareholders remain aligned. • Fixed remuneration comprising base salary, pension contributions

and applicable benefits valued at US$0.533 million was provided

The CEO and other Executive KMP are expected to grow their to Andrew for the period 1 January to 31 March 2020.

holdings to the MSR from the scheduled vesting of their employee

awards over time. The MSR is tested at the time that shares are • Upon his retirement from BHP, Andrew received his outstanding

to be sold. Shares may be sold to satisfy tax obligations arising accrued statutory leave entitlements valued at US$0.500 million.

from the granting, holding, vesting, exercise or sale of the The Remuneration Committee has adopted a de minimis threshold

employee awards or the underlying shares whether the MSR of US$7,500 for disclosure of payments to past Directors under

is satisfied at that time or not. UK requirements.

For FY2020: There were no payments made for loss of office in FY2020.

• the MSR for the CEO was five times annual pre-tax base salary

and Mike Henry’s shareholding was 4.1 times his annual pre-tax 3.3.25 Relative importance of spend on pay

base salary at the end of FY2020. As at the date of this Report,

Mike met the MSR; The table below sets out the total spend for Continuing operations

• the MSR for other Executive KMP was three times annual pre-tax on employee remuneration during FY2020 (and the prior year)

base salary. At the end of FY2020, Peter Beaven and Daniel compared with other significant expenditure items, and includes

Malchuk met the MSR, while Geraldine Slattery did not as she items as prescribed in the UK requirements. BHP has included tax

was appointed as Executive KMP on 18 March 2019. payments and purchases of property, plant and equipment being

No Executive KMP sold shares during FY2020, other than to satisfy the most significant other outgoings in monetary terms.

taxation obligations.

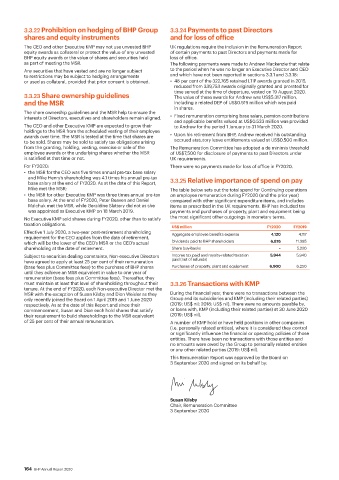

US$ million FY2020 FY2019

Effective 1 July 2020, a two-year post-retirement shareholding Aggregate employee benefits expense 4,120 4,117

requirement for the CEO applies from the date of retirement,

which will be the lower of the CEO’s MSR or the CEO’s actual Dividends paid to BHP shareholders 6,876 11,395

shareholding at the date of retirement. Share buy-backs – 5,220

Subject to securities dealing constraints, Non-executive Directors Income tax paid and royalty-related taxation 5,944 5,940

have agreed to apply at least 25 per cent of their remuneration paid (net of refunds)

(base fees plus Committee fees) to the purchase of BHP shares Purchases of property, plant and equipment 6,900 6,250

until they achieve an MSR equivalent in value to one year of

remuneration (base fees plus Committee fees). Thereafter, they

must maintain at least that level of shareholding throughout their 3.3.26 Transactions with KMP

tenure. At the end of FY2020, each Non-executive Director met the

MSR with the exception of Susan Kilsby and Dion Weisler as they During the financial year, there were no transactions between the

only recently joined the Board on 1 April 2019 and 1 June 2020 Group and its subsidiaries and KMP (including their related parties)

respectively. As at the date of this Report and since their (2019: US$ nil; 2018: US$ nil). There were no amounts payable by,

commencement, Susan and Dion each hold shares that satisfy or loans with, KMP (including their related parties) at 30 June 2020

their requirement to build shareholdings to the MSR equivalent (2019: US$ nil).

of 25 per cent of their annual remuneration. A number of KMP hold or have held positions in other companies

(i.e. personally related entities), where it is considered they control

or significantly influence the financial or operating policies of those

entities. There have been no transactions with those entities and

no amounts were owed by the Group to personally related entities

or any other related parties (2019: US$ nil).

This Remuneration Report was approved by the Board on

3 September 2020 and signed on its behalf by:

Susan Kilsby

Chair, Remuneration Committee

3 September 2020

164 BHP Annual Report 2020