Page 326 - Annual Report 2020

P. 326

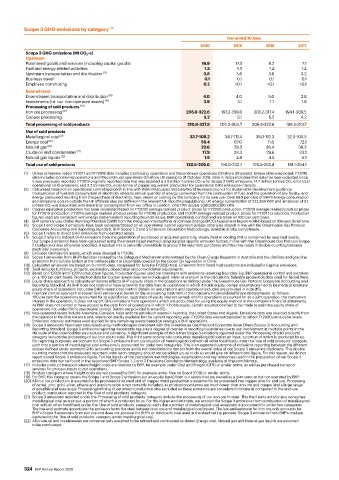

Scope 3 GHG emissions by category (16)

Year ended 30 June

2020 2019 2018 2017

Scope 3 GHG emissions (Mt CO 2 -e)

Upstream

Purchased goods and services (including capital goods) 16.9 17.3 8.2 7.7

Fuel and energy related activities 1.3 1.3 1.4 1.4

Upstream transportation and distribution (17) 3.8 3.6 3.6 3.2

Business travel 0.1 0.1 0.1 0.1

Employee commuting 0.2 <0.1 <0.1 <0.1

Downstream

Downstream transportation and distribution (18) 4.0 4.0 5.0 2.8

Investments (i.e. our non-operated assets) (19) 3.9 3.1 1.7 1.9

Processing of sold products (20)

Iron ore processing (21) 205.6-322.6 197.2-299.6 201.2-317.4 194.1-309.5

Copper processing 5.2 5.1 5.2 4.2

Total processing of sold products 210.8-327.8 202.3-304.7 206.4-322.6 198.3-313.7

Use of sold products

Metallurgical coal (21) 33.7-108.2 34.7-111.4 35.0-112.3 32.5-105.5

Energy coal (22) 56.4 67.0 71.0 72.1

Natural gas (22) 20.6 28.3 36.4 38.3

Crude oil and condensates (22) 17.9 23.3 29.6 33.1

Natural gas liquids (22) 1.9 2.8 4.5 5.1

Total use of sold products 130.5-205.0 156.0-232.7 176.5-253.8 181.1-254.1

(1) Unless otherwise noted, FY2017 and FY2018 data includes Continuing operations and Discontinued operations (Onshore US assets). Unless otherwise noted, FY2019

data includes Continuing operations and Discontinued operations (Onshore US assets) to 31 October 2018. Data in italics indicates that data has been adjusted since

it was previously reported. FY2019 originally reported data that was restated is 5.0 million tonnes CO 2 -e for Scope 2 GHG emissions, 14.7 million tonnes CO 2 -e for total

operational GHG emissions, and 2.2 tonnes CO 2 -e per tonne of copper equivalent production for operational GHG emissions intensity.

(2) Calculated based on an operational control approach in line with World Resources Institute/World Business Council for Sustainable Development guidance.

Consumption of fuel and consumption of electricity refers to annual quantity of energy consumed from the combustion of fuel; and the operation of any facility; and

energy consumed resulting from the purchase of electricity, heat, steam or cooling by the company for its own use. Over 99.9 per cent of BHP’s energy consumption

and emissions occurs outside the UK offshore area (as defined in the relevant UK reporting regulations). UK energy consumption of 222,368 kWh and emissions of 52

tonnes CO 2 -e is associated with electricity consumption from our office in London. One TWh equals 1,000,000,000 kWh.

(3) Copper equivalent production has been calculated based on FY2020 average realised product prices for FY2020 production, FY2019 average realised product prices

for FY2019 production, FY2018 average realised product prices for FY2018 production, and FY2017 average realised product prices for FY2017 production. Production

figures used are consistent with energy and emissions reporting boundaries (i.e. BHP operational control) and are taken on 100 per cent basis.

(4) BHP currently uses Global Warming Potentials (GWP) from the Intergovernmental Panel on Climate Change (IPCC) Assessment Report 4 (AR4) based on 100-year timeframe.

(5) Scope 1 and Scope 2 emissions have been calculated based on an operational control approach (unless otherwise stated) in line with the Greenhouse Gas Protocol

Corporate Accounting and Reporting Standard. BHP Scope 1, 2 and 3 Emissions Calculation Methodology, available at bhp.com/climate.

(6) Scope 1 refers to direct GHG emissions from operated assets.

(7) Scope 2 refers to indirect GHG emissions from the generation of purchased or acquired electricity, steam, heat or cooling that is consumed by operated assets.

Our Scope 2 emission have been calculated using the market-based method using supplier specific emission factors, in line with the Greenhouse Gas Protocol Scope

2 Guidance unless otherwise specified. A residual mix is currently unavailable to account for voluntary purchases and this may result in double counting between

electricity consumers.

(8) Excludes Onshore US assets, which were divested in FY2019.

(9) Scope 1 emissions from BHP’s facilities covered by the Safeguard Mechanism administered by the Clean Energy Regulator in Australia and the distillate and gasoline

emissions from turbine boilers at the cathode plant at Escondida covered by the Green Tax legislation in Chile.

(10) Calculated emissions are based on 11-month data, annualised for June for FY2020 total. Emissions from flared hydrocarbons are included in fugitive emissions.

(11) Total includes functions, projects, exploration, closed sites and consolidation adjustments.

(12) Based on FY2020 and FY2019 production figures. Production figures used are consistent with emissions reporting boundary (i.e. BHP operational control and are taken

on a 100 per cent basis). Production data for Copper assets does not include gold, silver or uranium in the calculation. Saleable production data used for Nickel West.

(13) Equity share approach to calculate emissions reflects BHP’s equity share in the operations as defined under the Greenhouse Gas Protocol Corporate Accounting and

Reporting Standard. As BHP does not control or have access to the data from all operations in which it holds equity, certain assumptions had to be made to estimate

equity share of operations not under BHP’s operational control. Details on assumptions and operations included are provided in note (15).

(14) Financial control approach to report GHG emissions is based on the accounting treatment in the company’s consolidated financial statements, as follows:

100 per cent for operations accounted for as subsidiaries, regardless of equity interest owned; and for operations accounted for as a joint operation, the company’s

interest in the operation. It does not report GHG emissions from operations which are accounted for using the equity method in the company’s financial statements.

As BHP does not control or have access to the data from all operations in which it holds equity, certain assumptions had to be made to estimate equity share of

operations not under BHP’s operational control. Details are provided in note (15).

(15) Non-operated assets include Antamina, Cerrejón, Kelar and the petroleum assets in Australia, the United States and Algeria. Emissions data was sourced directly from

the operator in the first instance and, where not readily available for the current reporting year, FY2019 data was extrapolated to reflect FY2020 production levels.

Emissions intensity estimates were applied for any remaining assets based on analogous BHP operations.

(16) Scope 3 emissions have been calculated using methodologies consistent with the Greenhouse Gas Protocol Corporate Value Chain (Scope 3) Accounting and

Reporting Standard. Scope 3 emissions reporting necessarily requires a degree of overlap in reporting boundaries due to our involvement at multiple points in the

life cycle of the commodities we produce and consume. A significant example of this is that Scope 3 emissions reported under the ‘Processing of sold products’

category include the processing of our iron ore to steel. This third party activity also consumes metallurgical coal as an input, a portion of which is produced by us.

For reporting purposes, we account for Scope 3 emissions from combustion of metallurgical coal with all other fossil fuels under the ‘Use of sold products’ category,

such that a portion of metallurgical coal emissions is accounted for under two categories. This is an expected outcome of emissions reporting between the different

scopes defined under standard GHG accounting practices and is not considered to detract from the overall value of our Scope 3 emissions disclosure. This double

counting means that the emissions reported under each category should not be added up, as to do so would give an inflated total figure. For this reason, we do not

report a total Scope 3 emissions figure. Further details of the calculation methodologies, assumptions and key references used in the preparation of our Scope 3

emissions data can be found in the associated BHP Scope 1, 2 and 3 Emissions Calculation Methodology, available at bhp.com/climate.

(17) Includes product transport where freight costs are covered by BHP, for example under Cost and Freight (CFR) or similar terms, as well as purchased transport

services for process inputs to our operations.

(18) Product transport where freight costs are not covered by BHP, for example under Free on Board (FOB) or similar terms.

(19) For BHP, this category covers the Scope 1 and Scope 2 emissions (on an equity basis) from our assets that are owned as a joint venture but not operated by BHP.

(20) All iron ore production is assumed to be processed into steel and all copper metal production is assumed to be processed into copper wire for end use. Processing

of nickel, zinc, gold, silver, ethane and uranium oxide is not currently included, as production volumes are much lower than iron ore and copper and a large range

of possible end uses apply. Processing/refining of petroleum products is also excluded as these emissions are considered immaterial compared to the end-use

product combustion reported in the ‘Use of sold products’ category.

(21) Scope 3 emissions reported under the ‘Processing of sold products’ category include the processing of our iron ore to steel. This third party activity also consumes

metallurgical coal as an input, a portion of which is produced by us. For the higher-end estimate, we account for Scope 3 emissions from combustion of metallurgical

coal with all other fossil fuels under the ‘Use of sold products’ category, such that a portion of metallurgical coal emissions is accounted for under two categories.

The low-end estimate apportions the emission factor for steel between iron ore and metallurgical coal inputs. The low-end estimate for iron ore only accounts for

BHP’s Scope 3 emissions from iron ore and does not account for BHP’s or third party coal used in the steelmaking process. Scope 3 emissions from BHP’s coal are

captured in the ‘Use of sold products’ category under metallurgical coal.

(22) All crude oil and condensates are conservatively assumed to be refined and combusted as diesel. Energy coal, Natural gas and Natural gas liquids are assumed

to be combusted.

324 BHP Annual Report 2020