Page 29 - Annual Report 2020

P. 29

1

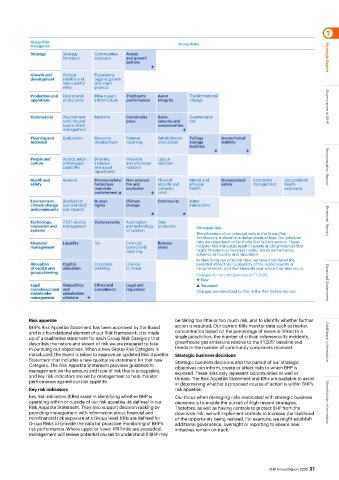

Group Risk Group Risks

Categories

Strategy Strategy Commodities Assets

formation exposure and growth Strategic Report

options

Growth and Political Expansions,

development stability and organic growth

new country and major

entry projects

Production and Operational Mine to port Third party Asset Transformational

operations productivity infrastructure performance integrity change Governance at BHP

Commercial Procurement Maritime Commodity Sales Counterparty

and inbound price security and risk

supply chain concentration

management

Planning and Exploration Resource Reserve Rehabilitation Tailings Geotechnical

technical development reporting and closure storage stability

facilities

People and Attract, retain Diversity, Industrial Labour

culture and engage inclusion and employee relations

capability and equal relations Remuneration Report

opportunity

Health and Aviation Process safety/ Non-process Physical Mental and Occupational Contractor Occupational

safety hazardous fire and security and physical safety management health

materials explosion company health exposures

containment ▲ crisis

Environment, Biodiversity Human Climate Community Water

climate change loss and land rights change interactions

and community use impacts

▲ ▲

Technology, IT/OT service Cybersecurity Automation Data Directors’ Report

innovation and management and technology protection Principal risks

systems innovation

The allocation of our principal risks to the Group Risk

Architecture is shown in a darker shade of blue. Our principal

Financial Liquidity Tax Financial Balance risks are described further in the Risk factors section. These

management control and sheet include risks that could result in events or circumstances that

reporting might threaten our business model, future performance,

solvency or liquidity and reputation.

In identifying our principal risks, we have considered the

Allocation Capital Corporate Licence potential impact and probability of the related events or

of capital and allocation planning to invest circumstances, and the timescale over which they may occur.

group planning

Changes to our principal risks in FY2020:

New

Legal Geopolitics Ethics and Legal and ▲ Renamed Financial Statements

compliance and and compliance regulatory

stakeholder stakeholder Changes are described further in the Risk factors section.

management relations

Risk appetite be taking too little or too much risk, and to identify whether further

BHP’s Risk Appetite Statement has been approved by the Board action is required. Our current KRIs monitor data such as market

and is a foundational element of our Risk Framework. It is made concentration based on the percentage of revenue linked to a

up of a qualitative statement for each Group Risk Category that single jurisdiction, the number of critical cybersecurity incidents,

describes the nature and extent of risk we are prepared to take greenhouse gas emissions relative to the FY2017 baseline and Additional information

in pursuing our objectives. When a new Group Risk Category is trends in the number of community complaints received.

introduced, the Board is asked to approve an updated Risk Appetite Strategic business decisions

Statement that includes a new qualitative statement for that new Strategic business decisions and the pursuit of our strategic

Category. The Risk Appetite Statement provides guidance to objectives can inform, create or affect risks to which BHP is

management on the amount and type of risk that is acceptable, exposed. These risks may represent opportunities as well as

and key risk indicators are set by management to help monitor threats. The Risk Appetite Statement and KRIs are available to assist

performance against our risk appetite. in determining whether a proposed course of action is within BHP’s

Key risk indicators risk appetite.

Key risk indicators (KRIs) assist in identifying whether BHP is Our focus when managing risks associated with strategic business

operating within or outside of our risk appetite, as defined in our decisions is to enable the pursuit of high-reward strategies. Shareholder information

Risk Appetite Statement. They also support decision-making by Therefore, as well as having controls to protect BHP from the

providing management with information about financial and downside risk, we will implement controls to increase the likelihood

non-financial risk exposure at a Group level. KRIs are defined for of the opportunity being realised. For example, we might establish

Group Risks to provide the data for proactive monitoring of BHP’s additional governance, oversight or reporting to ensure new

risk performance. Where upper or lower KRI limits are exceeded, initiatives remain on track.

management will review potential causes to understand if BHP may

BHP Annual Report 2020 27