Page 25 - BHP Economic Contribution Report 2020

P. 25

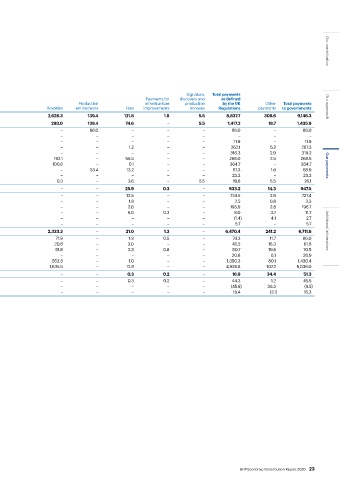

Signature, Total payments Our contribution

Payments for discovery and as defined

Corporate Royalty-related Taxes levied on Total taxes Production infrastructure production by the UK Other Total payments

US$ millions income taxes income taxes production paid Royalties entitlements Fees improvements bonuses Regulations payments to governments Our approach

Total payments to governments 5,458.6 459.3 25.0 5,942.9 2,626.3 139.4 121.8 1.8 5.5 8,837.7 308.6 9,146.3

Petroleum 501.0 378.7 25.0 904.7 293.0 139.4 74.6 – 5.5 1,417.2 18.7 1,435.9

Algeria Joint Interest Unit (1) – – – – – 86.0 – – – 86.0 – 86.0

Australia Joint Interest Unit – – – – – – – – – – – –

Australia Production Unit – Victoria 1.0 10.9 – 11.9 – – – – – 11.9 – 11.9

Australia Production Unit – Western Australia 155.3 105.6 – 260.9 – – 1.2 – – 262.1 5.2 267.3

Bass Strait 54.1 262.2 – 316.3 – – – – – 316.3 2.9 319.2

Gulf of Mexico 17.4 – – 17.4 192.1 – 56.5 – – 266.0 2.5 268.5

North West Shelf 239.0 – 25.0 264.0 100.6 – 0.1 – – 364.7 – 364.7 Our payments

Trinidad and Tobago Production Unit (2) 0.7 – – 0.7 – 53.4 13.2 – – 67.3 1.6 68.9

UK Production Unit 23.3 – – 23.3 – – – – – 23.3 – 23.3

Other 10.2 – – 10.2 0.3 – 3.6 – 5.5 19.6 6.5 26.1

Minerals Americas 821.7 85.3 – 907.0 – – 25.9 0.3 – 933.2 14.3 947.5

Escondida 626.7 85.3 – 712.0 – – 12.5 – – 724.5 2.9 727.4

Other Copper 0.7 – – 0.7 – – 1.8 – – 2.5 0.8 3.3

Pampa Norte 191.3 – – 191.3 – – 2.6 – – 193.9 2.8 196.7

Potash Canada (1.3) – – (1.3) – – 9.0 0.3 – 8.0 3.7 11.7

Head Office – BHP Brasil (1.4) – – (1.4) – – – – – (1.4) 4.1 2.7

Head Office – RAL Cayman Inc 5.7 – – 5.7 – – – – – 5.7 – 5.7

Minerals Australia 4,119.5 (4.7) – 4,114.8 2,333.3 – 21.0 1.3 – 6,470.4 241.2 6,711.6 Additional information

New South Wales Energy Coal – – – – 71.9 – 1.9 0.5 – 74.3 11.7 86.0

Nickel West 21.7 – – 21.7 20.8 – 3.0 – – 45.5 16.3 61.8

Olympic Dam (4.2) – – (4.2) 51.8 – 2.3 0.8 – 50.7 19.8 70.5

Other Coal 20.8 – – 20.8 – – – – – 20.8 6.1 26.9

Queensland Coal (3) 796.0 – – 796.0 553.3 – 1.0 – – 1,350.3 80.1 1,430.4

Western Australia Iron Ore 3,285.2 (4.7) – 3,280.5 1,635.5 – 12.8 – – 4,928.8 107.2 5,036.0

Group and Unallocated 16.4 – – 16.4 – – 0.3 0.2 – 16.9 34.4 51.3

Closed Sites 43.8 – – 43.8 – – 0.3 0.2 – 44.3 1.2 45.5

Corporate (4) (45.8) – – (45.8) – – – – – (45.8) 36.3 (9.5)

Commercial 18.4 – – 18.4 – – – – – 18.4 (3.1) 15.3

Figures are rounded to the nearest decimal point.

(1) Production entitlements of 1.5 million boe paid in-kind.

(2) Production entitlements of 3.1 million boe paid in-kind.

(3) Royalties, fees and other payments made by BM Alliance Coal Operations Pty Limited have been included in total payments to the extent of BHP’s ownership

of the operating entity, being 50 per cent.

(4) The corporate income tax amount does not represent a refund from a government. Instead, it represents the allocation of the Australian corporate income

tax payment among members of the Australian tax consolidation group. For further information, refer to ‘Basis of report preparation’ section.

BHP Economic Contribution Report 2020 23