Page 20 - BHP Economic Contribution Report 2020

P. 20

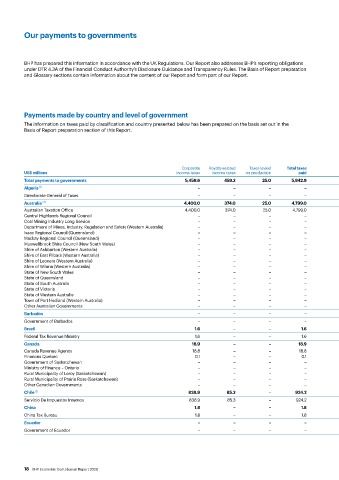

Our payments to governments

BHP has prepared this information in accordance with the UK Regulations. Our Report also addresses BHP’s reporting obligations

under DTR 4.3A of the Financial Conduct Authority’s Disclosure Guidance and Transparency Rules. The Basis of Report preparation

and Glossary sections contain information about the content of our Report and form part of our Report.

Payments made by country and level of government

The information on taxes paid by classification and country presented below has been prepared on the basis set out in the

Basis of Report preparation section of this Report.

Signature, Total payments

Payments for discovery and as defined

Corporate Royalty-related Taxes levied Total taxes Production infrastructure production by the UK Other Total payments

US$ millions income taxes income taxes on production paid Royalties entitlements Fees improvements bonuses Regulations payments to governments

Total payments to governments 5,458.6 459.3 25.0 5,942.9 2,626.3 139.4 121.8 1.8 5.5 8,837.7 308.6 9,146.3

Algeria (1) – – – – – 86.0 – – – 86.0 – 86.0

Directorate General of Taxes – – – – – 86.0 – – – 86.0 – 86.0

Australia (4) 4,400.0 374.0 25.0 4,799.0 2,433.9 – 22.4 1.3 – 7,256.6 259.5 7,516.1

Australian Taxation Office 4,400.0 374.0 25.0 4,799.0 – – – – – 4,799.0 36.0 4,835.0

Central Highlands Regional Council – – – – – – – – – – 2.0 2.0

Coal Mining Industry Long Service – – – – – – – – – – 13.5 13.5

Department of Mines, Industry, Regulation and Safety (Western Australia) – – – – 100.6 – – – – 100.6 – 100.6

Isaac Regional Council (Queensland) – – – – – – – – – – 9.2 9.2

Mackay Regional Council (Queensland) – – – – – – – – – – 0.5 0.5

Muswellbrook Shire Council (New South Wales) – – – – – – 0.1 0.5 – 0.6 2.7 3.3

Shire of Ashburton (Western Australia) – – – – – – – – – – 1.8 1.8

Shire of East Pilbara (Western Australia) – – – – – – 0.1 – – 0.1 2.4 2.5

Shire of Leonara (Western Australia) – – – – – – – – – – 0.7 0.7

Shire of Wiluna (Western Australia) – – – – – – – – – – 0.9 0.9

State of New South Wales – – – – 71.9 – 1.8 – – 73.7 7.6 81.3

State of Queensland – – – – 553.3 – 1.0 – – 554.3 54.2 608.5

State of South Australia – – – – 51.9 – 2.0 0.8 – 54.7 19.1 73.8

State of Victoria – – – – – – – – – – 5.5 5.5

State of Western Australia – – – – 1,656.2 – 15.8 – – 1,672.0 87.8 1,759.8

Town of Port Hedland (Western Australia) – – – – – – – – – – 15.0 15.0

Other Australian Governments – – – – – – 1.6 – – 1.6 0.6 2.2

Barbados – – – – – – 1.2 – 5.5 6.7 – 6.7

Government of Barbados – – – – – – 1.2 – 5.5 6.7 – 6.7

Brazil 1.6 – – 1.6 – – – – – 1.6 4.1 5.7

Federal Tax Revenue Ministry 1.6 – – 1.6 – – – – – 1.6 4.1 5.7

Canada 18.9 – – 18.9 – – 8.6 0.5 – 28.0 4.0 32.0

Canada Revenue Agency 18.8 – – 18.8 – – – – – 18.8 0.7 19.5

Finances Quebec 0.1 – – 0.1 – – – 0.2 – 0.3 0.1 0.4

Government of Saskatchewan – – – – – – 8.5 – – 8.5 0.1 8.6

Ministry of Finance – Ontario – – – – – – – – – – 0.1 0.1

Rural Municipality of Leroy (Saskatchewan) – – – – – – – 0.1 – 0.1 2.9 3.0

Rural Municipality of Prairie Rose (Saskatchewan) – – – – – – – 0.2 – 0.2 – 0.2

Other Canadian Governments – – – – – – 0.1 – – 0.1 0.1 0.2

Chile (2) 838.9 85.3 – 924.2 – – 15.8 – – 940.0 6.4 946.4

Servicio De Impuestos Internos 838.9 85.3 – 924.2 – – 15.8 – – 940.0 6.4 946.4

China 1.8 – – 1.8 – – – – – 1.8 – 1.8

China Tax Bureau 1.8 – – 1.8 – – – – – 1.8 – 1.8

Ecuador – – – – – – 0.3 – – 0.3 – 0.3

Government of Ecuador – – – – – – 0.3 – – 0.3 – 0.3

18 BHP Economic Contribution Report 2020