Page 15 - BHP Economic Contribution Report 2020

P. 15

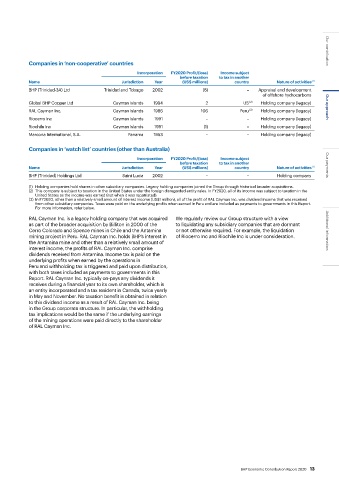

Companies in ‘non-cooperative’ countries Our contribution

Incorporation FY2020 Profit/(loss) Income subject

before taxation to tax in another

Name Jurisdiction Year (US$ millions) country Nature of activities (1)

BHP (Trinidad-3A) Ltd Trinidad and Tobago 2002 (8) – Appraisal and development

of offshore hydrocarbons

Global BHP Copper Ltd Cayman Islands 1994 2 US (2) Holding company (legacy)

RAL Cayman Inc. Cayman Islands 1986 106 Peru (3) Holding company (legacy) Our approach

Riocerro Inc Cayman Islands 1991 – – Holding company (legacy)

Riochile Inc Cayman Islands 1991 (1) – Holding company (legacy)

Marcona International, S.A. Panama 1953 – – Holding company (legacy)

Companies in ‘watch list’ countries (other than Australia)

Incorporation FY2020 Profit/(loss) Income subject

before taxation to tax in another

Name Jurisdiction Year (US$ millions) country Nature of activities (1) Our payments

BHP (Trinidad) Holdings Ltd Saint Lucia 2002 – – Holding company

(1) Holding companies hold shares in other subsidiary companies. Legacy holding companies joined the Group through historical broader acquisitions.

(2) This company is subject to taxation in the United States under the foreign disregarded entity rules. In FY2020, all of its income was subject to taxation in the

United States as the income was earned (not when it was repatriated).

(3) In FY2020, other than a relatively small amount of interest income (US$1 million), all of the profit of RAL Cayman Inc. was dividend income that was received

from other subsidiary companies. Taxes were paid on the underlying profits when earned in Peru and are included as payments to governments in this Report.

For more information, refer below.

RAL Cayman Inc. is a legacy holding company that was acquired We regularly review our Group structure with a view

as part of the broader acquisition by Billiton in 2000 of the to liquidating any subsidiary companies that are dormant

Cerro Colorado and Spence mines in Chile and the Antamina or not otherwise required. For example, the liquidation Additional information

mining project in Peru. RAL Cayman Inc. holds BHP’s interest in of Riocerro Inc and Riochile Inc is under consideration.

the Antamina mine and other than a relatively small amount of

interest income, the profits of RAL Cayman Inc. comprise

dividends received from Antamina. Income tax is paid on the

underlying profits when earned by the operations in

Peru and withholding tax is triggered and paid upon distribution,

with both taxes included as payments to governments in this

Report. RAL Cayman Inc. typically on-pays any dividends it

receives during a financial year to its own shareholder, which is

an entity incorporated and a tax resident in Canada, twice yearly

in May and November. No taxation benefit is obtained in relation

to this dividend income as a result of RAL Cayman Inc. being

in the Group corporate structure. In particular, the withholding

tax implications would be the same if the underlying earnings

of the mining operations were paid directly to the shareholder

of RAL Cayman Inc.

BHP Economic Contribution Report 2020 13