Page 22 - BHP Economic Contribution Report 2020

P. 22

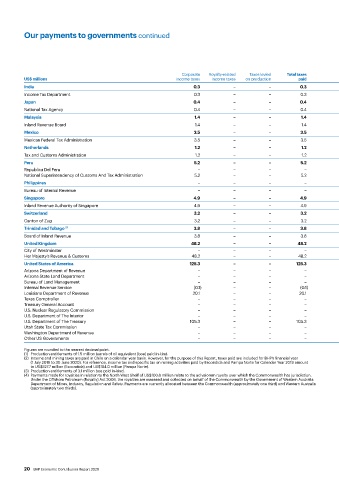

Our payments to governments continued

Signature, Total payments

Payments for discovery and as defined

Corporate Royalty-related Taxes levied Total taxes Production infrastructure production by the UK Other Total payments

US$ millions income taxes income taxes on production paid Royalties entitlements Fees improvements bonuses Regulations payments to governments

India 0.3 – – 0.3 – – – – – 0.3 – 0.3

Income Tax Department 0.3 – – 0.3 – – – – – 0.3 – 0.3

Japan 0.4 – – 0.4 – – – – – 0.4 – 0.4

National Tax Agency 0.4 – – 0.4 – – – – – 0.4 – 0.4

Malaysia 1.4 – – 1.4 – – – – – 1.4 – 1.4

Inland Revenue Board 1.4 – – 1.4 – – – – – 1.4 – 1.4

Mexico 3.5 – – 3.5 – – 2.3 – – 5.8 6.5 12.3

Mexican Federal Tax Administration 3.5 – – 3.5 – – 2.3 – – 5.8 6.5 12.3

Netherlands 1.2 – – 1.2 – – – – – 1.2 – 1.2

Tax and Customs Administration 1.2 – – 1.2 – – – – – 1.2 – 1.2

Peru 5.2 – – 5.2 – – 0.4 – – 5.6 0.1 5.7

Republica Del Peru – – – – – – 0.4 – – 0.4 – 0.4

National Superintendency of Customs And Tax Administration 5.2 – – 5.2 – – – – – 5.2 0.1 5.3

Philippines – – – – – – – – – – 0.5 0.5

Bureau of Internal Revenue – – – – – – – – – – 0.5 0.5

Singapore 4.9 – – 4.9 – – – – – 4.9 – 4.9

Inland Revenue Authority of Singapore 4.9 – – 4.9 – – – – – 4.9 – 4.9

Switzerland 3.2 – – 3.2 – – – – – 3.2 – 3.2

Canton of Zug 3.2 – – 3.2 – – – – – 3.2 – 3.2

Trinidad and Tobago (3) 3.8 – – 3.8 – 53.4 13.2 – – 70.4 1.6 72.0

Board of Inland Revenue 3.8 – – 3.8 – 53.4 13.2 – – 70.4 1.6 72.0

United Kingdom 48.2 – – 48.2 – – – – – 48.2 22.5 70.7

City of Westminster – – – – – – – – – – 1.0 1.0

Her Majesty’s Revenue & Customs 48.2 – – 48.2 – – – – – 48.2 21.5 69.7

United States of America 125.3 – – 125.3 192.4 – 57.6 – – 375.3 3.4 378.7

Arizona Department of Revenue – – – – – – – – – – 0.1 0.1

Arizona State Land Department – – – – – – 0.1 – – 0.1 0.5 0.6

Bureau of Land Management – – – – – – 0.1 – – 0.1 – 0.1

Internal Revenue Service (0.1) – – (0.1) – – 0.1 – – – 0.1 0.1

Louisiana Department of Revenue 20.1 – – 20.1 0.3 – – – – 20.4 – 20.4

Texas Comptroller – – – – – – – – – – 1.8 1.8

Treasury General Account – – – – – – – – – – 0.2 0.2

U.S. Nuclear Regulatory Commission – – – – – – 0.1 – – 0.1 – 0.1

U.S. Department of The Interior – – – – 192.1 – 56.5 – – 248.6 – 248.6

U.S. Department of The Treasury 105.3 – – 105.3 – – – – – 105.3 0.2 105.5

Utah State Tax Commission – – – – – – 0.1 – – 0.1 0.1 0.2

Washington Department of Revenue – – – – – – 0.5 – – 0.5 – 0.5

Other US Governments – – – – – – 0.1 – – 0.1 0.4 0.5

Figures are rounded to the nearest decimal point.

(1) Production entitlements of 1.5 million barrels of oil equivalent (boe) paid in-kind.

(2) Income and mining taxes are paid in Chile on a calendar year basis. However, for the purpose of this Report, taxes paid are included for BHP’s financial year

(1 July 2019 to 30 June 2020). For reference, income tax and specific tax on mining activities paid by Escondida and Pampa Norte for Calendar Year 2019 amount

to US$527.7 million (Escondida) and US$184.0 million (Pampa Norte).

(3) Production entitlements of 3.1 million boe paid in-kind.

(4) Payments made for royalties in relation to the North West Shelf of US$100.6 million relate to the ad valorem royalty over which the Commonwealth has jurisdiction.

Under the Offshore Petroleum (Royalty) Act 2006, the royalties are assessed and collected on behalf of the Commonwealth by the Government of Western Australia

Department of Mines, Industry, Regulation and Safety. Payments are currently allocated between the Commonwealth (approximately one third) and Western Australia

(approximately two thirds).

20 BHP Economic Contribution Report 2020