Page 69 - Annual Report 2020

P. 69

1

suitable as a proxy for an assessment of carbon risk to the portfolio. More information on the calculation methodologies, assumptions

The lower number, calculated to avoid double counting, provides and key references used in the preparation of Scope 3 emissions

a more useful input into an assessment of the total Scope 3 data can be found in the BHP Scope 1, 2 and 3 Emissions Calculation

Methodology, available at bhp.com/climate.

emissions associated with our value chains. Strategic Report

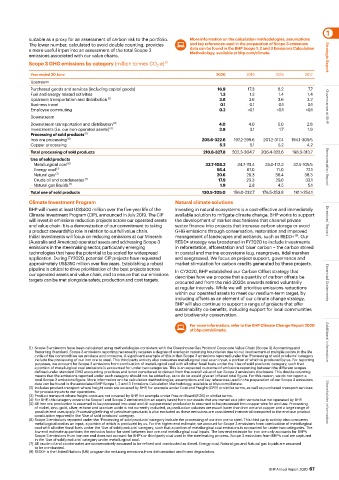

Scope 3 GHG emissions by category (million tonnes CO 2 -e) (1)

Year ended 30 June 2020 2019 2018 2017

Upstream

Purchased goods and services (including capital goods) 16.9 17.3 8.2 7.7

Fuel and energy related activities 1.3 1.3 1.4 1.4

Upstream transportation and distribution (2) 3.8 3.6 3.6 3.2

Business travel 0.1 0.1 0.1 0.1

Employee commuting 0.2 <0.1 <0.1 <0.1 Governance at BHP

Downstream

Downstream transportation and distribution (3) 4.0 4.0 5.0 2.8

Investments (i.e. our non-operated assets) (4) 3.9 3.1 1.7 1.9

Processing of sold products (5)

Iron ore processing (6) 205.6-322.6 197.2-299.6 201.2-317.4 194.1-309.5

Copper processing 5.2 5.1 5.2 4.2

Total processing of sold products 210.8-327.8 202.3-304.7 206.4-322.6 198.3-313.7

Use of sold products

Metallurgical coal (6) 33.7-108.2 34.7-111.4 35.0-112.3 32.5-105.5

Energy coal (7) 56.4 67.0 71.0 72.1 Remuneration Report

Natural gas (7) 20.6 28.3 36.4 38.3

Crude oil and condensates (7) 17.9 23.3 29.6 33.1

Natural gas liquids (7) 1.9 2.8 4.5 5.1

Total use of sold products 130.5-205.0 156.0-232.7 176.5-253.8 181.1-254.1

Climate Investment Program Natural climate solutions

BHP will invest at least US$400 million over the five-year life of the Investing in natural ecosystems is a cost-effective and immediately

Climate Investment Program (CIP), announced in July 2019. The CIP available solution to mitigate climate change. BHP works to support

will invest in emissions reduction projects across our operated assets the development of market mechanisms that channel private Directors’ Report

and value chain. It is a demonstration of our commitment to taking sector finance into projects that increase carbon storage or avoid

a product stewardship role in relation to our full value chain. GHG emissions through conservation, restoration and improved

Initial investments will focus on reducing emissions at our Minerals management of landscapes and wetlands, such as REDD+ . Our

(8)

(Australia and Americas) operated assets and addressing Scope 3 REDD+ strategy was broadened in FY2020 to include investments

emissions in the steelmaking sector, particularly emerging in reforestation, afforestation and ‘blue’ carbon – the carbon stored

technologies that have the potential to be scaled for widespread in coastal and marine ecosystems (e.g. mangroves, tidal marshes

application. During FY2020, potential CIP projects have requested and seagrasses). We focus on project support, governance and

approximately US$350 million over five years. Establishing a robust market stimulation for carbon credits generated by these projects.

pipeline is critical to drive prioritisation of the best projects across In CY2020, BHP established our Carbon Offset strategy that

our operated assets and value chain, and to ensure that our emissions describes how we propose that a quantity of carbon offsets be

targets can be met alongside safety, production and cost targets. procured and from the mid-2020s onwards retired voluntarily

at regular intervals. While we will prioritise emissions reductions Financial Statements

within our operated assets to meet our medium-term target, by

including offsets as an element of our climate change strategy,

BHP will also continue to support a range of projects that offer

sustainability co-benefits, including support for local communities

and biodiversity conservation.

For more information, refer to the BHP Climate Change Report 2020

at bhp.com/climate.

(1) Scope 3 emissions have been calculated using methodologies consistent with the Greenhouse Gas Protocol Corporate Value Chain (Scope 3) Accounting and Additional information

Reporting Standard. Scope 3 emissions reporting necessarily requires a degree of overlap in reporting boundaries due to our involvement at multiple points in the life

cycle of the commodities we produce and consume. A significant example of this is that Scope 3 emissions reported under the ‘Processing of sold products’ category

include the processing of our iron ore to steel. This third party activity also consumes metallurgical coal as an input, a portion of which is produced by us. For reporting

purposes, we account for Scope 3 emissions from combustion of metallurgical coal with all other fossil fuels under the ‘Use of sold products’ category, such that

a portion of metallurgical coal emissions is accounted for under two categories. This is an expected outcome of emissions reporting between the different scopes

defined under standard GHG accounting practices and is not considered to detract from the overall value of our Scope 3 emissions disclosure. This double counting

means that the emissions reported under each category should not be added up, as to do so would give an inflated total figure. For this reason, we do not report a

total Scope 3 emissions figure. More information on the calculation methodologies, assumptions and key references used in the preparation of our Scope 3 emissions

data can be found in the associated BHP Scope 1, 2 and 3 Emissions Calculation Methodology, available at bhp.com/climate.

(2) Includes product transport where freight costs are covered by BHP, for example under Cost and Freight (CFR) or similar terms, as well as purchased transport services

for process inputs to our operations.

(3) Product transport where freight costs are not covered by BHP, for example under Free on Board (FOB) or similar terms.

(4) For BHP, this category covers the Scope 1 and Scope 2 emissions (on an equity basis) from our assets that are owned as a joint venture but not operated by BHP.

(5) All iron ore production is assumed to be processed into steel and all copper metal production is assumed to be processed into copper wire for end use. Processing Shareholder information

of nickel, zinc, gold, silver, ethane and uranium oxide is not currently included, as production volumes are much lower than iron ore and copper and a large range of

possible end uses apply. Processing/refining of petroleum products is also excluded as these emissions are considered immaterial compared to the end-use product

combustion reported in the ‘Use of sold products’ category.

(6) Scope 3 emissions reported under the ‘Processing of sold products’ category include the processing of our iron ore to steel. This third party activity also consumes

metallurgical coal as an input, a portion of which is produced by us. For the higher-end estimate, we account for Scope 3 emissions from combustion of metallurgical

coal with all other fossil fuels under the ‘Use of sold products’ category, such that a portion of metallurgical coal emissions is accounted for under two categories. The

low-end estimate apportions the emission factor for steel between iron ore and metallurgical coal inputs. The low-end estimate for iron ore only accounts for BHP’s

Scope 3 emissions from iron ore and does not account for BHP’s or third party coal used in the steelmaking process. Scope 3 emissions from BHP’s coal are captured

in the ‘Use of sold products’ category under metallurgical coal.

(7) All crude oil and condensates are conservatively assumed to be refined and combusted as diesel. Energy coal, Natural gas and Natural gas liquids are assumed

to be combusted.

(8) REDD+ is the United Nations (UN) program for reducing emissions from deforestation and forest degradation.

BHP Annual Report 2020 67