Page 9 - Annual Report 2020

P. 9

1

Bringing people and

resources together to Strategic Report

build a better world

Our values

Sustainability

Integrity

Respect

Performance Governance at BHP

We work

Simplicity in more than

Accountability 90

Through: An asset-centric focus Capital allocation Capability Culture Technology

locations

We prioritise: Safety and sustainability Exceptional performance A winning portfolio

80,000 Remuneration Report

employees

and

contractors

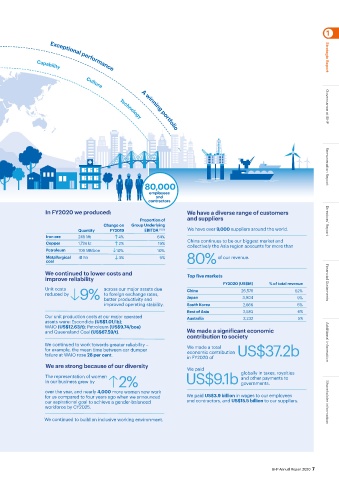

A strong set of results, safely achieved We remained true to our In FY2020 we produced: We have a diverse range of customers

environmental commitments

and suppliers

Proportion of

challenging year across the globe. 0 Fatalities gas emissions by at least 30% Quantity Change on Group Underlying We have over 9,000 suppliers around the world. Directors’ Report

Our people maintained an

unwavering focus on safety in a

We set a target to reduce

EBITDA

FY2019

(2) (3)

our operational greenhouse

by FY2030

Copper

2%

1,724 kt

19%

(1)

Total recordable injury 11% to 4.2 per (from FY2020 levels ) and our long-term goal is to Iron ore 248 Mt 4% 64% China continues to be our biggest market and

collectively the Asia region accounts for more than

frequency fell million hours achieve net-zero operational emissions by 2050. Petroleum 109 MMboe 10% 10%

worked. Metallurgical 41 Mt 3% 9% 80% of our revenue.

In line with our water stewardship commitments and our coal

Safety remains our top priority and we continue to five-year public target for water, we continued to reduce

search for ways to improve safety across our business. our freshwater withdrawals, with FY2020 withdrawals We continued to lower costs and

now 19 per cent below our FY2017 baseline, exceeding Top five markets

High potential injuries (HPI) decreased by our 15 per cent reduction target. improve reliability

16 per cent from FY2019 and the frequency rate FY2020 (US$M) % of total revenue Financial Statements

decreased by 23 per cent. Unit costs 9% across our major assets due China 26,576 62%

We eliminated extraction of groundwater for operational reduced by to foreign exchange rates,

supply purposes at Escondida 10 years ahead of better productivity and Japan 3,904 9%

HPI trends remain a primary focus to assess progress schedule, and announced a move to 100 per cent improved operating stability. South Korea 2,666 6%

against our most important safety objective: renewable power for Escondida and Spence by the

to eliminate fatalities. mid-2020s. Our unit production costs at our major operated Rest of Asia 2,583 6%

5%

Australia

2,232

We contributed to social value in the We delivered a strong financial performance assets were: Escondida (US$1.01/lb);

WAIO (US$12.63/t); Petroleum (US$9.74/boe)

communities in which we operate and Queensland Coal (US$67.59/t). We made a significant economic

contribution to society

US$150m Our Attributable US$8.0b Additional information

profit was

We invested We continued to work towards greater reliability – We made a total US$37.2b

for example, the mean time between car dumper

(2)

in environmental and social programs, including and our Underlying EBITDA was US$22.1 billion, failure at WAIO rose 28 per cent. economic contribution

in FY2020 of

at an Underlying EBITDA margin of 53 per cent.

(2)

responding to the COVID-19 pandemic through

social investment funds. We are strong because of our diversity

We generated free cash flow of US$8.1 billion. We paid

(2)

Our balance sheet remains strong, with net debt at The representation of women globally in taxes, royalties

(2)

During FY2020, 12 per cent of our external expenditure US$12.0 billion and at the bottom of our target range. 2% US$9.1b and other payments to

was with local suppliers. An additional 84 per cent of in our business grew by governments.

our supply expenditure was located within the regions

in which we operate. We created value for our shareholders over the year, and nearly 4,000 more women now work

for us compared to four years ago when we announced We paid US$3.9 billion in wages to our employees

Total dividends of 120 US cents per share and basic our aspirational goal to achieve a gender-balanced and contractors, and US$15.5 billion to our suppliers. Shareholder information

We embedded social value priorities into our annual earnings per ordinary share of 157.3 US cents. workforce by CY2025.

business planning process. Our underlying return on capital employed was 17%.

(2)

We continued to build an inclusive working environment.

(1) FY2020 baseline will be adjusted for any material acquisitions and divestments based on GHG emissions at the time of the transaction.

Carbon o¢sets will be used as required.

(2) For more information on Alternative Performance Measures, refer to section 6.1.

(3) Percentage contribution to Group Underlying EBITDA, excluding Group and unallocated items (G&U includes Potash, Nickel West and

closed mines previously reported in Petroleum reportable segment). Energy coal and Nickel have not been presented.

BHP Annual Report 2020 7