Page 3 - Annual Report 2020

P. 3

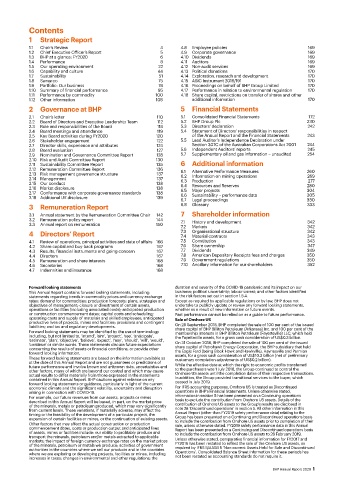

Contentss

Content

1 Strategic Report

1.1 Chair’s Review 4 4.8 Employee policies 169

1.2 Chief Executive Officer’s Report 5 4.9 Corporate governance 169

1.3 BHP at a glance: FY2020 6 4.10 Dividends 169

1.4 Performance 8 4.11 Auditors 169

1.5 Our operating environment 22 4.12 Non-audit services 169

1.6 Capability and culture 44 4.13 Political donations 170

1.7 Sustainability 51 4.14 Exploration, research and development 170

1.8 Samarco 75 4.15 ASIC Instrument 2016/191 170

1.9 Portfolio: Our business 78 4.16 Proceedings on behalf of BHP Group Limited 170

1.10 Summary of financial performance 95 4.17 Performance in relation to environmental regulation 170

1.11 Performance by commodity 100 4.18 Share capital, restrictions on transfer of shares and other

1.12 Other information 108 additional information 170

2 Governance at BHP 5 Financial Statements

2.1 Chair’s letter 110 5.1 Consolidated Financial Statements 172

2.2 Board of Directors and Executive Leadership Team 112 5.2 BHP Group Plc 230

2.3 Role and responsibilities of the Board 118 5.3 Directors’ declaration 242

2.4 Board meetings and attendance 119 5.4 Statement of Directors’ responsibilities in respect

2.5 Key Board activities during FY2020 120 of the Annual Report and the Financial Statements 243

2.6 Stakeholder engagement 122 5.5 Lead Auditor’s Independence Declaration under

2.7 Director skills, experience and attributes 124 Section 307C of the Australian Corporations Act 2001 244

2.8 Board evaluation 127 5.6 Independent Auditors’ reports 245

2.9 Nomination and Governance Committee Report 128 5.7 Supplementary oil and gas information – unaudited 254

2.10 Risk and Audit Committee Report 130

2.11 Sustainability Committee Report 135 6 Additional information

2.12 Remuneration Committee Report 136 6.1 Alternative Performance Measures 260

2.13 Risk management governance structure 137 6.2 Information on mining operations 269

2.14 Management 137 6.3 Production 277

2.15 Our conduct 138 6.4 Resources and Reserves 280

2.16 Market disclosure 138 6.5 Major projects 304

2.17 Conformance with corporate governance standards 138 6.6 Sustainability – performance data 305

2.18 Additional UK disclosure 139 6.7 Legal proceedings 330

3 Remuneration Report 6.8 Glossary 333

3.1 Annual statement by the Remuneration Committee Chair 142 7 Shareholder information

3.2 Remuneration policy report 144 7.1 History and development 342

3.3 Annual report on remuneration 150 7.2 Markets 342

342

4 Directors’ Report 7.3 Organisational structure 343

7.4 Material contracts

4.1 Review of operations, principal activities and state of affairs 166 7.5 Constitution 343

4.2 Share capital and buy-back programs 167 7.6 Share ownership 347

4.3 Results, financial instruments and going concern 167 7.7 Dividends 349

4.4 Directors 167 7.8 American Depositary Receipts fees and charges 350

4.5 Remuneration and share interests 168 7.9 Government regulations 350

4.6 Secretaries 168 7.10 Ancillary information for our shareholders 352

4.7 Indemnities and insurance 168

Forward looking statements duration and severity of the COVID-19 pandemic and its impact on our

This Annual Report contains forward looking statements, including: business; political uncertainty; labour unrest; and other factors identified

statements regarding trends in commodity prices and currency exchange in the risk factors set out in section 1.5.4.

rates; demand for commodities; production forecasts; plans, strategies and Except as required by applicable regulations or by law, BHP does not

objectives of management; closure or divestment of certain assets, undertake to publicly update or review any forward looking statements,

operations or facilities (including associated costs); anticipated production whether as a result of new information or future events.

or construction commencement dates; capital costs and scheduling; Past performance cannot be relied on as a guide to future performance.

operating costs and supply of materials and skilled employees; anticipated Sale of Onshore US

productive lives of projects, mines and facilities; provisions and contingent

liabilities; and tax and regulatory developments. On 28 September 2018, BHP completed the sale of 100 per cent of the issued

Forward looking statements may be identified by the use of terminology share capital of BHP Billiton Petroleum (Arkansas) Inc. and 100 per cent of the

membership interests in BHP Billiton Petroleum (Fayetteville) LLC, which held

including, but not limited to, ‘intend’, ‘aim’, ‘project’, ‘see’, ‘anticipate’, the Fayetteville assets, for a gross cash consideration of US$0.3 billion.

‘estimate’, ‘plan’, ‘objective’, ‘believe’, ‘expect’, ‘may’, ‘should’, ‘will’, ‘would’, On 31 October 2018, BHP completed the sale of 100 per cent of the issued

‘continue’ or similar words. These statements discuss future expectations

concerning the results of assets or financial conditions, or provide other share capital of Petrohawk Energy Corporation, the BHP subsidiary that held

the Eagle Ford (being Black Hawk and Hawkville), Haynesville and Permian

forward looking information. assets, for a gross cash consideration of US$10.3 billion (net of preliminary

These forward looking statements are based on the information available as customary completion adjustments of US$0.2 billion).

at the date of this Annual Report and are not guarantees or predictions of While the effective date at which the right to economic profits transferred

future performance and involve known and unknown risks, uncertainties and

other factors, many of which are beyond our control and which may cause to the purchasers was 1 July 2018, the Group continued to control the

Onshore US assets until the completion dates of their respective transactions.

actual results to differ materially from those expressed in the statements

contained in this Annual Report. BHP cautions against reliance on any In addition, the Group provided transitional services to the buyer, which

ceased in July 2019.

forward looking statements or guidance, particularly in light of the current

economic climate and the significant volatility, uncertainty and disruption For IFRS accounting purposes, Onshore US is treated as Discontinued

arising in connection with COVID-19. operations in BHP’s Financial Statements. Unless otherwise stated,

For example, our future revenues from our assets, projects or mines information in section 5 has been presented on a Continuing operations

described in this Annual Report will be based, in part, on the market price basis to exclude the contribution from Onshore US assets. Details of the

contribution of Onshore US assets to the Group’s results are disclosed in

of the minerals, metals or petroleum produced, which may vary significantly

from current levels. These variations, if materially adverse, may affect the note 28 ‘Discontinued operations’ in section 5. All other information in this

Annual Report (other than FY2019 safety performance data) relating to the

timing or the feasibility of the development of a particular project, the

expansion of certain facilities or mines, or the continuation of existing assets. Group has been presented on a Continuing and Discontinued operations basis

to include the contribution from Onshore US assets prior to completion of their

Other factors that may affect the actual construction or production sale, unless otherwise stated. FY2019 safety performance data in this Annual

commencement dates, costs or production output and anticipated lives Report has been presented on a Continuing and Discontinued operations basis

of assets, mines or facilities include: our ability to profitably produce and to include the contribution from Onshore US assets to 28 February 2019.

transport the minerals, petroleum and/or metals extracted to applicable

markets; the impact of foreign currency exchange rates on the market prices Unless otherwise stated, comparative financial information for FY2017 and

FY2016 has been restated to reflect the sale of the Onshore US assets, as

of the minerals, petroleum or metals we produce; activities of government

authorities in the countries where we sell our products and in the countries required by IFRS 5/AASB 5 ‘Non-current Assets Held for Sale and Discontinued

Operations’. Consolidated Balance Sheet information for these periods has

where we are exploring or developing projects, facilities or mines, including

increases in taxes; changes in environmental and other regulations; the not been restated as accounting standards do not require it.

BHP Annual Report 2020 1